MobileTrader

MobileTrader: platform dagangan di hujung jari!

Muat turun dan mulakan sekarang!

31.03.2025 01:01 PM

31.03.2025 01:01 PMEurope's gas sector is entering a critical phase, as the end of the heating season sets the stage for refilling storage facilities, which are now two-thirds empty after the winter months.

Typically, traders play a central role in replenishing reserves, since summer gas prices are generally lower, allowing them to profit by storing large volumes for sale during the next heating season when demand rises again.

However, industry experts note that this year is far from typical. The first truly cold winter since Europe lost most of its pipeline gas supply from Russia depleted reserves more rapidly than usual. The situation was further exacerbated when Ukraine halted the remaining transit flows on January 1. The resulting market squeeze has led to a persistent rise in summer gas prices, which have now surpassed next winter's prices.

A key question now is what role governments will play in ensuring storage is replenished. State intervention could range from direct subsidies for producers and consumers to the establishment of strategic reserves and export restrictions. Each of these options comes with trade-offs. Subsidies may encourage production and lower costs for consumers, but they can also distort the market and lead to inefficient resource allocation.

There is still ample time before the next winter season, but many market participants believe that the first few weeks of April will offer a clear indication of whether stakeholders are ready to begin restocking despite the unfavorable price structure, or whether they intend to wait for more advantageous market conditions.

The stakes are high. If the European Union enters the next winter with partially filled storage, the region could face a sharp spike in prices in the event of severe cold or other unexpected disruptions. European Commission rules stipulate that storage facilities must be 90% full by November 1. However, recent proposals and discussions about introducing flexibility in the timeline for reaching these targets have created significant uncertainty. This has caused price fluctuations and left traders guessing about how the rules will ultimately be applied.

Gas futures declined amid speculation that storage targets might be relaxed, along with optimism about a possible resolution to the conflict in Ukraine. According to some economists, gas prices are currently about 50% higher than a year ago. The price—just above €40 per megawatt-hour—is expected to remain at or above current levels over the next few weeks, depending heavily on liquefied natural gas (LNG) demand this summer.

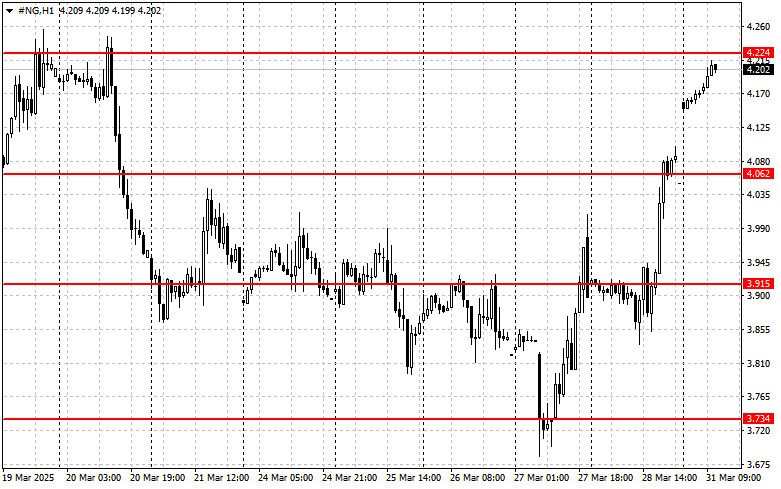

Regarding the technical outlook for natural gas (NG), buyers are now focused on reclaiming the 4.224 level. A breakout above this range would open a direct path toward 4.373 and the more significant resistance at 4.502. The furthest upside target lies in the 4.600 area. On the downside, initial support stands around 4.062. A breakdown below this level would likely send the instrument lower to 3.915, with the most distant bearish target located near 3.734.

MobileTrader: platform dagangan di hujung jari!

Muat turun dan mulakan sekarang!

Anda telah pun menyukai siaran hari ini

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Jika anda mempunyai sebarang soalan berkaitan kandungan, sila hubungi editorial-board@instaforex.com

Jika anda mempunyai sebarang soalan berkaitan kandungan, sila hubungi editorial-board@instaforex.com

Hari ini, yen Jepun menghadapi cabaran untuk meneruskan pengukuhannya disebabkan perkembangan optimistik berhubung rundingan perdagangan dan penangguhan tarif. Kenyataan Presiden Trump mengenai pengecualian yang mungkin untuk industri automotif mungkin memberikan

Pada hari Isnin, pasaran sedikit tenang berikutan tindakan Donald Trump yang kelihatan berundur dari halangan perdagangan yang telah beliau kenakan kepada rakan dagang Amerika Syarikat. Ini memberi gambaran bahawa presiden

Walaupun konflik perdagangan masih belum menemui jalan damai, seolah-olah satu bentuk gencatan senjata mula kelihatan. Rumah Putih mula sedar secara tergesa-gesa bahawa dasar perlindungan yang dilaksanakan telah melampaui batas

Beberapa peristiwa makroekonomi dijadualkan pada hari Selasa, tetapi dalam keadaan semasa, data makroekonomi memberikan sedikit kesan kepada pasaran. Ia mungkin mempunyai impak jangka pendek dan setempat pada pergerakan pasangan mata

Pasangan mata wang GBP/USD meneruskan pergerakan menaiknya pada hari Isnin. Seperti euro, tiada sebab khusus untuk pasangan ini mengalami penurunan. Sudah tentu, kenaikan semasa ini semakin kelihatan berlebihan dan sering

Pada hari Isnin, pasangan mata wang EUR/USD meneruskan pergerakan menaik. Walaupun pertumbuhan kali ini lebih perlahan, pasangan ini terus meningkat. Semalam menyaksikan peningkatan 50 pip; hari ini, ia naik sebanyak

Aliran menaik dalam pasangan EUR/USD kekal stabil di tengah-tengah kelemahan keseluruhan dolar AS. Penurunan harga yang ketara memberikan peluang kepada pembeli untuk membuka kedudukan beli pada harga yang lebih menguntungkan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.