Cryptocurrency mining occupies a key position in the world of digital assets. Although it is far from the only way to obtain cryptocurrencies, mining remains the main method for popular coins like Bitcoin and Ethereum.

How does mining work? This process involves creating new blocks, which are essential for maintaining the operation of cryptocurrency blockchains.

Most often, mining refers to adding new blocks to the blockchain. To do this, miners solve complex mathematical tasks related to finding the correct hash that matches pre-set criteria. Once the solution is found, it can be quickly verified.

The most productive miner, who is the first to complete all the necessary calculations, receives a reward from the network. This reward, called the “block reward,” typically consists of new coins and sometimes includes transaction fees contained in the block.

The main goal of a miner is to solve the task first and claim the reward. In this article, we will discuss how mining works and cover all the details of this process.

Understanding cryptocurrency mining

The term "mining" comes from the English word for extracting minerals. Miners are essentially “extracting” digital assets, which they then use for selling or, naturally, for making a profit.

This difficult mathematical process requires very powerful computers and specialized hardware capable of solving hard mathematical problems.

The blockchain is a chain of blocks that serves as a massive database simultaneously stored on many devices. For well-known cryptocurrencies, this database is distributed across thousands, sometimes millions, of computers around the world.

Cryptocurrencies are stored within these blocks, access to which is only possible with a unique key (or hash). This system prevents the duplication of coins and protects against fraud.

How does mining work? Each block is the result of computations performed on participants’ devices. When a transaction reaches the miners, the process of calculating the necessary key begins.

The generated hash is then verified by other network participants according to set security rules. Only after this do miners receive their reward, which is credited to their cryptocurrency wallet.

Despite the lack of regulation by governments or financial institutions, mining is still regarded as one of the most reliable systems.

Network participants can transfer keys to one another, granting access to their digital assets.

It is important to remember that without the required hash, a transaction cannot be confirmed, making any attempt at data theft futile.

Moreover, hacking the blockchain is impossible due to its decentralized data storage structure, which makes the system resistant to any hacker attacks.

History of cryptocurrency mining

The very first miner in the world became the creator of Bitcoin himself—a certain Satoshi Nakamoto. There are many stories and rumors online suggesting that before the launch of Bitcoin, Nakamoto allegedly mined a huge number of coins in secret, securing a fortune for himself.

However, official data claims that Satoshi was able to mine only 750 Bitcoins.

At the dawn of the cryptocurrency era, coins were mined using the central processors of the most basic computers. This method quickly proved inefficient due to high energy consumption and, of course, insufficient computing power.

This was precisely the moment when the era of graphics cards and specialized devices such as ASICs (Application-Specific Integrated Circuits) began.

Entire companies emerged in the US, focusing on the development and production of such equipment. Among them, ASICminer, Avalon, and Butterfly Labs became prominent names in the market.

These companies update their devices every year in order to keep pace with rapid technological progress and competitors.

Mining equipment has undergone significant changes over the years, and this is far from the limit as its evolution continues at a rapid pace.

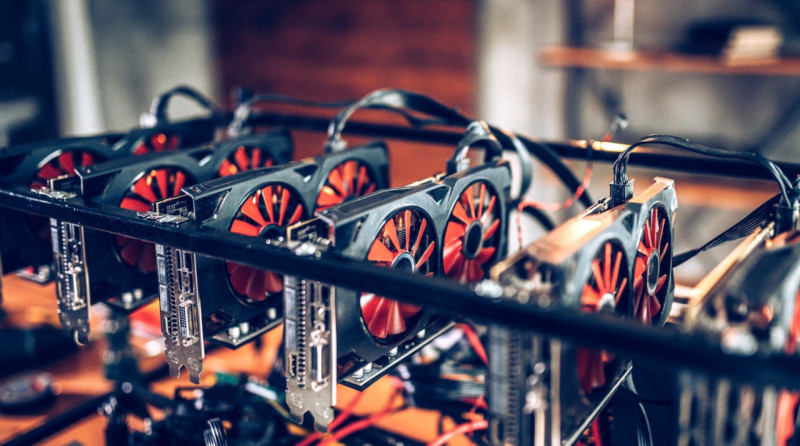

Today, professional miners invest substantial funds in setting up farms made of graphics cards and ASIC boards, as well as in specialized equipment such as cooling systems and uninterruptible power supplies.

Technology never stands still. It keeps moving forward, and almost every day, innovations are born in both mining technology and the broader history of cryptocurrency mining.

Security mechanisms in mining

Understanding how mining works is impossible without considering the mechanisms that ensure the security of transactions and the creation of new blocks.

Some of the most common algorithms are Proof-of-Work (PoW) and Proof-of-Stake (PoS). There are also other algorithms, but they are typically used in individual projects for which they were specifically developed.

The Proof-of-Work algorithm (the name literally means “proof of work performed”) is actively used in cryptocurrencies such as Bitcoin and Ethereum.

Proof-of-Work means that to confirm a transaction, a complex computational problem must be solved. The greater the computing power, the higher the mining speed and, consequently, the reward.

This process led to the emergence of specialized equipment—ASIC devices—which help boost productivity in cryptocurrency mining.

PoW does have a significant drawback: the more resources are involved, the more difficult the mining process becomes. Ultimately, this results in increased energy consumption.

For instance, in 2021, more than 100 terawatt-hours of electricity were spent on mining Bitcoin. It is an amount comparable not just to the energy consumption of individual cities, but entire countries.

As an alternative to PoW, the Proof-of-Stake algorithm—proof of ownership (stake)—was developed. Here, the probability of mining new cryptocurrency depends on how many coins a network participant holds.

Proof-of-Stake offers a significant advantage. It reduces energy consumption. However, the downside of PoS is that it lowers the level of decentralization in the network.

In 2022, the Ethereum cryptocurrency switched to the PoS algorithm. This not only cut energy consumption many times over, but also, to some extent, solved the problem of video card shortages required for the mining process.

Mining algorithms

In this section, we will discuss the main cryptographic algorithms that form the basis of cryptocurrency mining hardware.

Here are some of them:

| Mining Algorithm | Description |

| SHA-256 | When using this algorithm, a 256-bit signature is generated during mining. It takes about 7 minutes to process a single block, and for efficient operation you need at least 1 Gh/s (gigahash per second). This algorithm is the basis for cryptocurrencies such as Bitcoin, 21Coin, Bytecoin, and Terracoin. |

| Ethash | This hashing algorithm was first applied in the Ethereum network. The amount of video memory plays an important role in this algorithm. It is used in the networks of Ethereum Classic, Ubiq, and KodakCoin. |

| Scrypt | An improved version of the Proof-of-Work algorithm. It increases mining speed and significantly reduces hardware requirements (compared to SHA-256). Applied in the networks of Dogecoin, Litecoin, and Gulden. |

| Equihash | This algorithm allows cryptocurrencies to be mined even on ordinary computers. It is ideal for mining coins such as Komodo, Zcash, and Bitcoin Gold. |

| CryptoNight | With this algorithm, mining can be done even on computers with low-performance graphics cards. It is used to mine Bytecoin and Monero. |

| X11 | Created specifically for the Dash cryptocurrency. This algorithm is characterized by low energy consumption and a fairly high level of security. |

Modern cryptographic algorithms are equipped with robust protection against ASIC mining, which allows them to maintain a high level of network decentralization.

This operating principle prevents the concentration of computing power in the hands of large industrial miners, which is crucial for sustaining an even distribution of resources across the network. Such protection, for instance, is implemented in the Dash network.

Conditions for successful mining

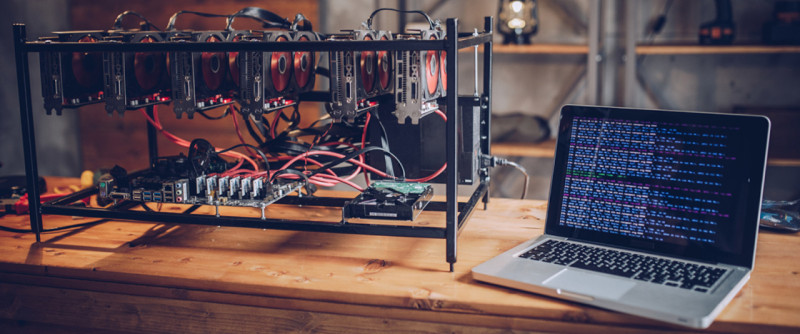

All knowledge about how mining works is meaningless without a clear business plan. Before you start mining, it is crucial to carefully develop a plan to follow.

One of the key points in this plan is accounting for electricity costs. This resource directly affects the profitability of mining, and its price can play a decisive role in the success of your project.

If you plan to set up a full-scale mining farm, it is important to consider aspects such as soundproofing and cooling for your equipment in advance. Unfortunately, without proper conditions, the hardware will fail very quickly.

Additionally, you will need sufficient space for your equipment, especially if you are mining on a large scale.

If you intend to mine at home, a single graphics card might be enough.

However, you should always approach your choice of hardware carefully. You need to purchase equipment that delivers maximum performance with minimal maintenance costs.

You must understand your equipment from a technical perspective, as you will need to monitor its operation consistently to ensure the stability of the entire process.

Equipment for home mining computer

Selecting mining equipment depends on the specifics of each cryptocurrency. Therefore, it is important not only to study the entire process and the mining algorithm but also to take individual features into account.

At the same time, there is a universal set of components suitable for most cases.

If you plan to build a mining rig yourself, you will need the following elements:

- 6–8 graphics cards

- Motherboard

- Power supply unit

- Processor

- Hard drive or SSD

- Wi-Fi adapter

- RAM (operational memory)

- Risers for connecting the graphics cards

- A case to house all these components

In addition to the number of graphics cards, their performance significantly affects mining efficiency. It is recommended to choose graphics cards with DDR5 memory of at least 2 GB and a 256-bit memory bus.

For example, for mining Ethereum, it is recommended to use equipment from manufacturers such as NVIDIA and AMD, as their hardware is particularly well-suited for mining this cryptocurrency.

Specialized equipment

This category includes devices known as ASIC miners (commonly called "ASICs").

These specialized devices are designed to perform calculations using specific algorithms with maximum efficiency. Thanks to their high processing power (hashrate), ASICs have almost entirely replaced graphics cards for mining cryptocurrencies using algorithms such as SHA-256, Scrypt, X11, Qubit, and Quark.

Their main advantages include instant readiness for operation, high reliability, and no need for frequent hardware updates.

However, ASIC miners are not without drawbacks. One problem is the difficulty of repairs, as well as the limited number of supported algorithms.

Additionally, the noise level they generate is quite high, so for comfortable use, it is necessary to allocate a separate room for such devices.

Types of mining

Mining is both a complex and expensive process. In order to understand how mining works, it is worth classifying it by the type of equipment used and by the number of participants:

| Types based on equipment | Types based on number of participants |

|

|

|

|

|

|

Let us consider each category in more detail.

Types of mining based on equipment

1. Mining on CPU (central processors)

At the dawn of the cryptocurrency industry, when the difficulty of mining coins was low, it was possible to mine directly on home computers with ordinary processors.

Today, however, CPUs are not powerful enough for mining, especially when it comes to major cryptocurrencies such as Bitcoin or Litecoin, all due to the high level of network difficulty.

2. Mining on GPU (graphics cards)

When cryptocurrency mining became more difficult, miners began to use graphics cards to increase performance. Graphics cards ultimately turned out to be significantly more effective than processors, but as the mining difficulty increased, even their power quickly became insufficient.

3. Mining on ASIC (application-specific integrated circuits)

ASICs are specialized devices, developed exclusively for mining according to specific algorithms. "ASICs" are much more powerful than CPUs or GPUs; they provide significantly higher performance.

Their use made mining much more efficient, leading to a mass shift to this unique equipment.

To increase performance, miners began combining several devices into mining farms. Such farms, arranged in spacious, well-ventilated facilities, allow much greater coin extraction thanks to increased computational power.

Types of mining based on number of participants

1. Solo mining (individual mining)

In this case, the miner mines cryptocurrency alone, using their own equipment.

All earned rewards and transaction commissions remain with the miner. However, due to the high difficulty of mining Bitcoin and other popular coins, solo mining has become less profitable and is used today primarily for mining new, lesser-known cryptocurrencies.

The high costs of equipment and electricity have made this method simply unprofitable.

2. Mining pools

Mining pools emerged in response to the increased complexity of mining popular cryptocurrencies. In a pool, several miners combine their power on a server, increasing the chances of finding a new block.

The block reward is shared among all participants according to the computing power of their equipment. Pools usually take a small commission for their services.

3. Cloud mining

This type of mining involves renting computing power from the owners of large mining farms. Miners rent part of this capacity, pay for the rental, and the farm owners take care of all equipment maintenance, setup, and ensuring its operation.

This concept is quite beneficial for miners, as it allows them to receive income without the need to buy and maintain their own equipment.

Profitability of mining and potential risks

One of the first questions that concerns beginner miners is not how mining works, but how to make a profit from this process and how quickly the invested funds will pay off.

It is impossible to give an unambiguous answer to these questions, since the level of profitability of mining cryptocurrencies depends on several factors at once:

1. Mining difficulty:

The more complex the algorithm, the more powerful and, accordingly, the more expensive the equipment must be to perform it, whether it is purchased, assembled, or rented.

2. Cryptocurrency exchange rate:

The value of cryptocurrencies in fiat money also affects income.

3. Cost of equipment:

As cryptocurrency prices rise, so too does the cost of mining hardware, particularly graphics cards, the price of which has increased by 1.5 to 2 times or more.

Despite these factors, the average payback period of investments in mining has remained at about 1 year.

Depending on the cryptocurrency used and the price of equipment, this period can vary: from 6–8 months up to 1.5–2 years, especially in the case of weak equipment.

How can one calculate profitability and risks in mining? There are many calculators available on the internet that allow you to assess the efficiency of equipment. One such tool is the NiceHash calculator, which helps to roughly estimate possible income based on entered parameters.

The main risk in mining is associated with the volatility of cryptocurrency exchange rates. Regardless of whether you are mining Bitcoin or altcoins, a sharp drop in the exchange rate can lead to a significant reduction in profit, and electricity costs can exceed income.

In addition, it should be noted that mining equipment is a very complex technology, and purchasing a low-quality device or dealing with an unreliable seller can cause technical problems.

Therefore, it is very important to carefully check equipment sellers, study their reputation, and avoid making purchases on unverified websites offering used equipment.

From a legal point of view, there are currently no serious risks in mining.

Advantages and disadvantages of cryptocurrency mining

Advantages:

1. Easy and simple to start.

Many people strive for additional income without any significant effort, and that is precisely why mining has become so popular.

To get started, it is sufficient to purchase special equipment, assemble a mining farm, and install the necessary software. After that, you can simply launch the process, and cryptocurrency mining will begin.

2. Variety of cryptocurrencies and dynamic exchange rates.

Fluctuating cryptocurrency exchange rates provide opportunities to choose the most profitable coins for mining, which helps maximize profits.

3. Ease of exchanging cryptocurrency.

The coins mined can easily be exchanged for fiat money through various popular payment systems, for example, via QIWI, PayPal, Webmoney, and others. You can also use another highly demanded exchange method by using bank cards such as VISA and Mastercard.

Disadvantages:

1. Risks when purchasing equipment and market instability.

The cost of equipment can change significantly, and as a result, devices that generated good profit just a few years ago may no longer bring the same income today.

Additionally, the cryptocurrency market is subject to strong fluctuations, which makes mining income quite unpredictable.

2. High initial investment.

In order to start mining, a significant initial capital is required. Equipment that used to be available at affordable prices now costs many times more.

3. High electricity consumption.

Mining consumes a huge amount of electricity. Altogether, miners use much more energy than entire countries such as Iceland, Ireland, and Nigeria combined.

Staking as worthy alternative to mining

If you plan to invest in cryptocurrency but do not intend to spend money on expensive equipment or are looking for a more predictable source of income, then staking may be the ideal solution for you.

Unlike mining, staking does not require the purchase of complex hardware. All you need is a certain amount of cryptocurrency in your account.

After you lock up your assets, you begin to receive interest for holding them.

Cryptocurrencies in 2024

In 2024, there are more than 7,800 different cryptocurrencies. However, most of them do not have significant popularity, and only a small portion accounts for about 80% of the total market capitalization.

All cryptocurrencies can be classified according to their type, purpose, and real value.

There are four main types of cryptocurrencies:

| Cryptocurrencies operating on Proof of Work (PoW) | This principle is based on the concept of proof of completing a certain amount of work, which underlies blockchain technology. A prominent example of such cryptocurrencies is Bitcoin. |

| Cryptocurrencies operating on Proof of Stake (PoS) | These cryptocurrencies operate on the principle of providing proof of ownership. This is fundamentally different from PoW, since here holders of the cryptocurrency have the right to create new blocks based on the amount of coins they own. Examples include Dash, EOS, and Tron. |

| Tokens | These cryptocurrencies are designed to perform specialized functions, such as purchasing digital assets. Tokens may be tied to specific projects or ecosystems. |

| Stablecoins | Cryptocurrencies secured by assets that maintain a stable value. Their price is not subject to sharp fluctuations. The best-known stablecoin is Tether, followed by Gemini, Paxos, and TrueUSD. |

In addition to the types listed above, there are also central bank digital currencies (CBDCs), governance tokens, and privacy coins.

The first are digital versions of national currencies, such as the USD and EUR.

Governance tokens give users the right to vote on decisions within projects. Privacy coins (for example, Monero or Zcash) are designed to ensure the anonymity of transactions.

As for "altcoins," this is not a separate category of cryptocurrencies, but rather a general term for all digital assets except Bitcoin.

Legality of cryptocurrency mining in different countries

Now that the question of how mining works is clear, what about whether it is legal to engage in this activity today?

Over the past five years, legislative bodies have made various attempts to regulate issues related to digital assets. Consideration has been given to a wide range of proposals: from the full legalization of mining and cryptocurrency circulation within a particular country, to their prohibition with the introduction of fines and prison terms.

There has also been discussion about creating a national cryptocurrency or the possibility that, over time, these assets will lose their value.

On the international stage, the situation regarding cryptocurrency regulation is rapidly developing. Authorities in different countries are seeking to establish control over these assets, striving to combat anonymity and the spread of uncontrolled alternatives to traditional money.

In some countries, cryptocurrency has already been recognized as an official means of payment, and in some places, it is already used as a unit of account, while in others, it is considered a commodity or investment asset.

As for mining, the situation is also ambiguous. There are several key factors that may affect the legality of mining in different countries.

One of the most important is energy consumption and its impact on the environment. As repeatedly noted, mining requires significant amounts of electricity, so in countries where energy resources are expensive or scarce, it may be significantly restricted or outright banned.

Similarly, in regions where environmental protection is a priority, crypto mining may be limited or prohibited to prevent harmful effects on nature.

Another aspect is national security. In some countries, mining can be viewed as a threat if it allows significant capital to flow abroad through private individuals or organizations.

In such countries, restrictions may be introduced on cryptocurrency mining to prevent capital outflow and protect the domestic economy.

Tax regulation also plays an important role. In some countries, mining may be subject to high taxes or strict regulations aimed at combating tax evasion or money laundering.

This can make crypto mining too costly or complicated, effectively turning it into an illegal activity.

At present, cryptocurrency mining is allowed in a number of countries, such as the United States, Canada, Australia, and most of Europe. In these regions, miners can legally engage in cryptocurrency mining, provided they comply with local laws and regulations.

At the same time, there are countries where mining is either strictly prohibited or heavily restricted. For example, China has completely banned crypto mining, citing excessive electricity consumption and negative environmental impact.

In Russia and Iran, there are also restrictions in place on mining, aimed at preventing capital flight and protecting the economic interests of the state.

Conclusion

Thus, we have examined how mining works, what types of this process exist, and its legal status in various countries.

In conclusion, it should be said that mining remains one of the most attractive ways to earn passive income in the cryptocurrency industry, even though this labor-intensive process sometimes requires considerable investment.

However, if you plan to use your own equipment, the initial costs may not be so significant, for example, up to several thousand dollars.

For those who are just starting their journey in mining, it may be worth considering renting equipment. However, it is important to remember that while "cloud" mining requires less investment, it is generally less reliable and less profitable.

It is very important to keep in mind that mining difficulty is constantly increasing. But along with these risks, new promising cryptocurrencies are emerging that can offer very interesting opportunities.

Remember that it is not at all necessary to limit yourself to mining only major coins. Today, the market offers other equally attractive options that can also generate decent income.

Back to articles

Back to articles