Analysis of Trades and Trading Tips for the British Pound

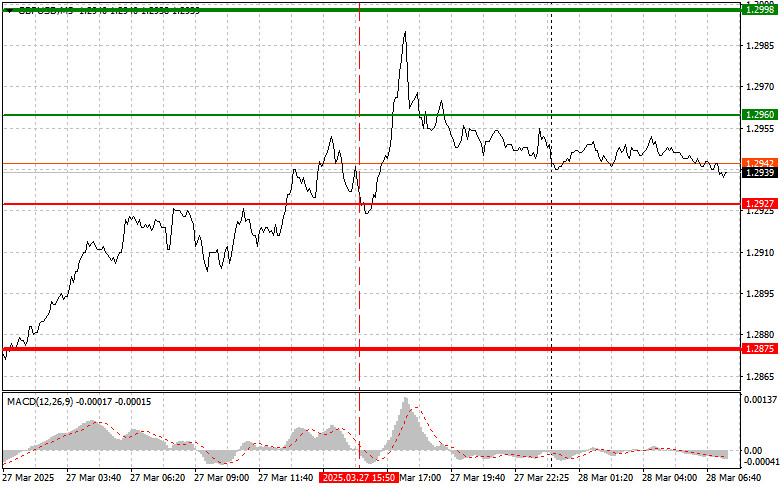

The price test at 1.2927 occurred when the MACD indicator started moving down from the zero mark, confirming a valid entry point for selling the pound. However, as you can see on the chart, the decline never materialized, resulting in a loss.

Demonstrating some resilience, the British currency found support in its struggle against the U.S. dollar, even reaching new weekly highs. However, the triumph was short-lived. Under pressure from strong U.S. data, the pound failed to maintain its gains and ceded momentum. The GDP figures were positive and supported the U.S. dollar significantly. Investors, reassured by signs of the U.S. economy's stability, quickly adjusted their portfolios to favor the dollar, weakening the pound's position.

Today may mark a potential return of interest in the GBP/USD pair, but that will require favorable conditions—specifically, the release of robust economic data from the UK. The day will begin with the Nationwide House Price Index, which could set the tone for further trading. Following that, investors will closely watch the retail sales data. The highlight will be the release of the final GDP figures for the previous year's fourth quarter, providing a complete picture of the country's economic activity. If all these indicators exceed economists' expectations, a significant strengthening of the British pound against the U.S. dollar could be expected.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today if the price reaches the entry point near 1.2950 (green line on the chart), aiming for a rise to 1.2987 (thicker green line on the chart). Around 1.2987, I plan to exit long positions and open short positions in the opposite direction (expecting a 30–35 pip pullback from the level). A bullish move in the pound can only be expected after strong economic data. Important! Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.2932 level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger an upward market reversal. A rise toward the opposite levels of 1.2950 and 1.2987 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after the 1.2932 level (red line on the chart) is broken, which would lead to a quick drop in the pair. The key target for sellers will be the 1.2904 level, where I plan to exit short positions and immediately open long positions in the opposite direction (expecting a 20–25-pip rebound from the level). It's better to sell the pound as high as possible. Important! Before selling, make sure the MACD indicator is below the zero line and starting to decline from it.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.2950 level while the MACD indicator is in the overbought zone. This would limit the pair's upside potential and trigger a reversal to the downside. A decline toward the opposite levels of 1.2932 and 1.2904 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.