The US Federal Open Market Committee will hold a meeting this week. The regulator may decide on a record-high rate hike of 0.75% at once. How can it affect the current situation and can the Fed curb inflation? Let's find the answers in this article.

In the run-up to the Fed meeting, analysts make a lot of forecasts. Some believe that the rate will be raised, after which the Federal Reserve will move to a softer policy, some, on the contrary, assume that the rate increase will fail to curb inflation, as a result of which the regulator will continue to tighten monetary policy. Some assume and hope that after the cycle of rate hikes, there will soon be a cycle of rate cuts and the quantitative easing program will be resumed. We can guess, but we have an objective indicator of the situation, namely the chart of the index of commodity futures prices - CRB, which allows us to make decisions based on the forecast of its movement (Figure 1).

Fig.1. Thomson Reuters/Jefferies CRB Index chart

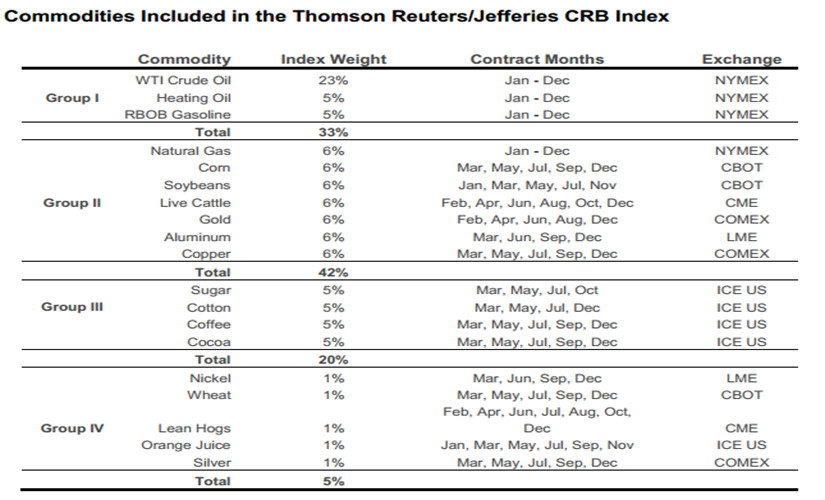

The CRB Index tracks futures contracts for 21 strategic commodities, including oil, natural gas, industrial metals, food, and other assets, with energy commodities given greater weight, indicating their special role in global commodity price formation. Energy accounts for 39% of the index, giving it key importance (Figure 2).

There are other variants of displaying commodity prices in indices constructed according to different methods, but CRB is one of the oldest indicators and, as it seems to me, the most balanced one. This does not exclude the use of other variants of constructing commodity indicators for analysis either by weight or by different groups, but the principle of their use will be approximately the same. We analyze the behavior of the index and try to determine the most likely direction of movement.

Fig.2. Composition of the CRB commodity price index

Before making assumptions about future inflation, let's consider the movement of the CRB index (Figure 1). As it is seen on the chart, the peak of commodity prices was in June, when the index reached 330, after which there was a decrease, and in July CRB went into consolidation near the level of 280. Thus, we can state that in June and July commodity prices fell by 15%, which was reflected in a reduction of inflationary pressure. This allowed some analysts to declare that commodity prices had reached their peak, which means that the Fed will soon ease the pace of rate hikes, which, in turn, will have a positive effect on the US economy and the US stock market. Such statements, for example, were made by analysts of JP Morgan bank.

The correlation between interest rates and the commodity market can be described as follows: commodity prices rise, which raises inflation, and the Fed responds by raising rates, which slows the economy and makes the US dollar more expensive, resulting in lower demand for goods, and the more expensive US dollar makes commodity prices lower, which leads to less inflationary pressure.

However, as we can see on the chart, the prices of the commodities are now at the important technical support of 280, above the 200-day moving average. Thus, the current decline in commodity prices is not a reversal, but merely a correction to an uptrend.

If the Fed manages to curb oil prices by strengthening the US dollar and bring down other factors, such as a decline in the US stock market, then commodity prices may go down. This, in turn, is likely to weaken inflation. The problem is that the price of oil (Fig. 3) and other commodities have recently been out of the hands of the Fed, and oil prices are key to inflation and its pressure on the US economy.

The lack of ability to manipulate prices on US exchanges poses a significant limitation to the system that may prevent the Fed from implementing its plan to curb inflation by cooling the US economy. As it was noted above, unfortunately for the Biden administration, in recent years the price of oil has not been determined by the US, but by the OPEC+, which holds about 40% of world oil production.

Fig.3. Brent price chart

US domestic oil production is also important, but its level cannot be significantly increased shortly. US oil companies are exposed to rising costs associated with higher wages and materials. The industry has suffered from years of underfunding, and refineries have a worn-out infrastructure.

At the same time, the current prices are quite satisfactory for OPEC+. Despite its best efforts, the organization cannot increase production now. Russia is under sanctions, which has taken an additional 1 million barrels off the market. The problem is also that 65% of all proven oil reserves that could be exploited in the coming decades are owned by state companies from Saudi Arabia, the UAE, Kuwait, Russia, Venezuela, and Iran. Most of them are under US and EU sanctions.

If we talk about the current situation in the oil market, the market may be now forming a reversal to further price increases. As follows from the latest COT Report, traders are closing short positions they opened against purchases of oil-focused exchange-traded funds. These trades suggest that speculators, traders, and hedge fund managers may have begun to believe that the 20% collapse in oil prices that has lasted since mid-June may soon be over, and prices may rise soon.According to S3 Partners analyst company data quoted by Bloomberg, the largest US ETF focused on oil stocks, Energy Select Sector SPDR Fund (NYSEARCA: XLE), over the last month has reduced short positions by 14%. XLE assets consist of major US oil companies' stocks such as ExxonMobil, Chevron, Occidental, ConocoPhillips, and EOG Resources.

These signals from various markets confirm the idea that the decline of the US stock prices and even the fall of the US GDP into the negative zone may not lead to a decrease in oil prices, which will remain above $100 for Brent. At the same time, we cannot rule out the possibility of a decline in oil prices either.

In order not to sound confusing, I will tell you my plan. I opened a long position on North American oil WTI, available on the InstaForex trading platform under the #CL ticker, with targets at 110 and 122.50 with a Stop Loss order placed below 90. The risk of the trade is no more than 1% of the deposit amount.

As for the Fed's actions to raise the rate, their efforts may not be efficient, resulting in both a higher rate and lower inflation, but that would be a different story. Be careful and follow risk management rules!